Will The American People Succeed In Clawing-Back Their Democracy?

Authored by Paul Craig Roberts,

With much help from the failures of neoliberal economic policy and neoconservative foreign policy, we are changing the world.

Authored by Paul Craig Roberts,

With much help from the failures of neoliberal economic policy and neoconservative foreign policy, we are changing the world.

Op-Ed via RT.com,

It was expected ISIS would turn against the Ankara regime at some point, and Turks are now paying the price for creating and training a monster like this, political analyst Roula Talj told RT. The worst has started between Turks and IS, she concluded.

Gideon Rachman thinks that the Leave campaign has the edge in the “Brexit” debate:

And in politics, as the saying goes: “If you are explaining, you are losing.” Ominously, early focus groups suggest that, when undecided voters are exposed to the arguments of both sides of the debate, they are more likely to move towards a vote to leave [bold mine-DL]. The polls also show that anti-EU voters are more likely to vote than the pro-EU camp. Meanwhile, Europe is looking like an increasingly tough sell, what with the euro crisis and the refugee one.

Trump spoke with The Washington Post editors about his foreign policy views, which they described as “unabashedly non-interventionist” in one place but also described this way:

Speaking ahead of a major address on foreign policy later Monday in front of the American Israel Public Affairs Committee, Trump said he advocates an aggressive U.S. posture in the world with a light footprint [bold mine-DL].

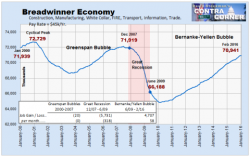

Submitted by David Stockman via Contra Corner blog,

It’s actually pretty easy. At an apt moment very soon, Trump should offer Governor Kasich the VP slot and Senator Cruz the vacant Supreme Court seat.