Bank of America: "The Impact Of A Very Dovish Message Is Bad For Risk Assets"

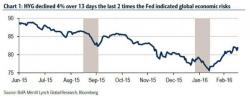

In a note that may have been quite prescient, BofA's HY strategist Michael Contopoulos released a note last night titled "Fed acknowledges global growth concerns… again", in which he said that "we have to admit; today’s dovish comments by Yellen took us by surprise" and adds that "although the market’s initial reaction was positive, we think the longer run impact of a very dovish message is bad for risk assets. In fact, we’re a bit amazed by the initial response from high yield today."