Can a Christian Party Survive?

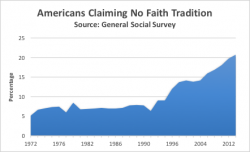

In the past several years, many trees have been felled and pixels electrocuted in the service of discussion about the impact of Hispanics on the American electorate. No one knows for sure which way they’ll vote in the future but everyone is interested in discussing it. Curiously, though, an even larger political shift is taking place yet receiving almost no attention whatsoever from political reporters—the emergence of post-Christian America.