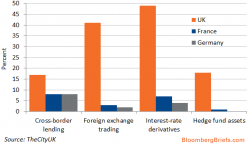

Brexit!? France & Germany Cannot Wait

Via GEFIRA,

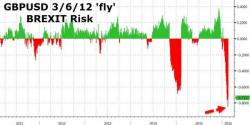

If London decides to leave the European Union nobody in Europe will even notice. Great Britain is an entirely separate country, isolated from the European Union and does not participate in the Euro or Schengen Agreement. The European Union as a political platform is disintegrating and becoming more and more irrelevant and will be displaced by the European Monetary Union (EMU).