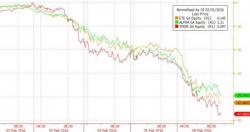

Europe Closes "On The Lows": Deutsche Bank Plunges 11% To 7 Year Lows

BTFD? Deutsche Bank stock crashed over 11% today (the most since July 2009) to its lowest since January 2009 record lows. We have detailed at length why this is a major systemic problem and we wonder how anyone can view this chart and not question their full faith in central planners engineering of the 'recovery'. Nothing is fixed and it's starting to become very obvious!

Does this look like a buying opportunity? At EUR13.465 today, DB is within pennies of the all-time record lows of EUR13.385...