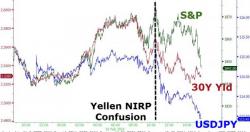

Yellen Sinks Stocks, Craters Credit

Damn It, Janet!

Yellen’s testimony Wed. “was not dovish relative to market expectations,” and didn’t take March off table, Morgan Stanley strategists Matthew Hornbach, Chirag Mirani, Guneet Dhingra write in note.

She “qualified most of the downside risks to the economic outlook with a positive spin,” while implying that tighter financial conditions need to persist in order for Fed’s economic outlook to change