Asian Market Rout Goes Global On Tech, Tax And Government Shutdown Tremors

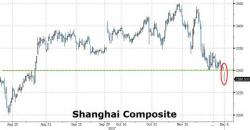

A selloff which started in Asia, driven by renewed liquidation of Chinese and Hong Kong tech stocks and accelerated by weaker metal prices which pushed the Shanghai Composite below a key support and to 4 month lows...