"Bad News Is Great Again" - Global Stocks Soar After Yellen Admits Global Economy Is Much Weaker

At the end of the day, it was all about the dollar.

At the end of the day, it was all about the dollar.

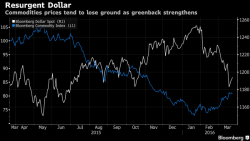

With Europe back from Easter break, we are seeing a modest continuation of the dollar strength witnessed every day last week, which in turn is pressuring oil and the commodity complex, and leading to some selling in US equity futures (down 0.2% to 2024) ahead of today's main event which is Janet Yellen's speech as the Economic Club of New York at 12:20pm, an event which judging by risk assets so far is expected to be far more hawkish than dovish: after all the S&P 500 is north of 2,000 for now.

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all global risk assets.

Following two days of rangebound moves, where Monday's modest market rebound was undone by the Tuesday just as modest decline (despite the early surge higher on the latest "bullish for stocks" European terrorism), overnight equity action continued to be more of the same, and as of this moment S&P 500 futures were unchanged, while European stocks were modestly higher.

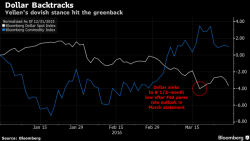

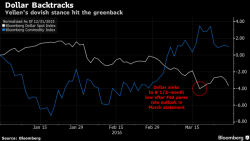

It may be option expiration day (always leading to abnormal market activity) but it remains all about the weak dollar, which after crashing in the two days after the Fed's surprisingly dovish statement has put both the ECB and the BOJ in the very awkward position that shortly after both banks have drastically eased, the Euro and the Yen are now trading stronger relative to the dollar versus prior.