Dollar Flash Crashes On Last Trading Day Of 2016

It is oddly appropriate that in a year everyone finally admitted markets are manipulated by central banks and broken by HFT algos, that on the last trading day of 2016, the dollar flash crashed with for no reason whatsoever.

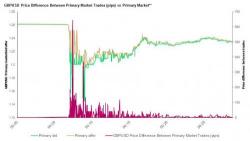

Shortly after 6:30pm Eastern, the dollar plunged by 150 pips against the Euro, once 1.05 stops were taken out, with algos sending the EURUSD as high as 1.07 in a matter of seconds...