Get Out Now: SocGen Predicts Market Crash, Bear Market For The S&P

While the charade of sellside analysts releasing optimistic, and in the case of Barclays and Goldman "rationally exuberant"previews of the year ahead...

While the charade of sellside analysts releasing optimistic, and in the case of Barclays and Goldman "rationally exuberant"previews of the year ahead...

S&P 500 futures are higher, continuing on yesterday's momentum, after European and Asian shares also rose alongside a rebound in oil, as the year-end performance chase appears to be accelerating. There were several different moving parts in a mixed European session, in which early Euro strength gave way to weakness...

... which in turn pushed the Stoxx 600 and US index futures higher, rising above yesterday's session high on negligible volumes.

Yesterday's torrid, broad-based rally looked set to continue overnight until early in the Japanese session, when the USD tumbled and dragged down with it the USDJPY, Nikkei, and US futures following a WSJ report that Robert Mueller had issued a subpoena to more than a dozen top Trump administration officials in mid October.

Authored by 720Global's Michael Liebowitz via RealInvestmentAdvice.com,

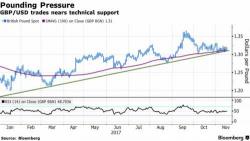

“Before long, we will all begin to find out the extent to which Brexit is a gentle stroll along a smooth path to a land of cake and consumption.” – Mark Carney, Bank of England Governor

After five consecutive daily losses on the MSCI world stock index and seven straight falls in Europe, there was finally a bounce, as investors returned to global equity markets in an optimistic mood on Thursday, sending US futures higher after several days of losses as global stocks rebounded following a Chinese commodity-driven rout.