"Triple Threat Thursday" Starts Off With A Whimper: Markets On Edge Ahead Of Key Event Risks

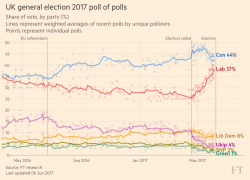

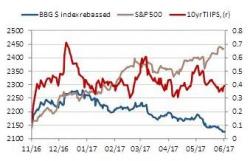

So far "Triple Threat Thursday" has been a dud. In the day with the greatest concentration of market-moving risk events so far in 2017, market action - at least for the time being - has been a whimper, with European stocks and US futures modestly higher ahead of the ECB’s rate decision and Comey's testimony (which has now been fully publicized, removing much of the risk), as the U.K. voting is underway. Asian stocks fell led by a decline in Japan as the yen first strengthened, only to tumble later in the session.