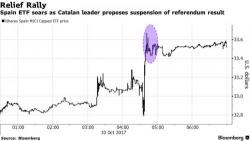

S&P Futures Flat, Spain Rebounds, Nikkei Closes At 21 Year High

S&P500 futures point to a slightly lower open, as Asian stocks rise to trade near decade highs, with Japan’s Nikkei 225 closing at highest since 1996. European stocks are little changed, with Spanish shares gaining after Catalan President rows back from an immediate declaration of independence. MSCI's all-world stocks index briefly hit a fresh record high in opening European trading as a 1.5% jump in Spain's IBEX added to a 10-year high set by Asian shares overnight.