Greece Is In Trouble Again: Bonds, Stocks Plunge As Bailout Talks Collapse; IMF Sees "Explosive" Debt

It may - or may not - shock readers to learn that Greece is once again on the verge of collapse.

It may - or may not - shock readers to learn that Greece is once again on the verge of collapse.

The spread of global cash bans continues with Greece unveiling their so-called 'soft' approach by which taxpayers will only be granted tax-allowances or deductions when payments are made via credit or debit cards. As KeepTalkingGreeece reports, the new guidelines refer to employees, pensioners, farmers, and also the unemployed.

Accepted expenditure will be:

It is not a secret and it is not new that public hospitals in Greece collapsed. As Keep TalkingGreece.com notes, the first budget cuts imposed with the first bailout agreement affected the public health. Seven years later, the situation goes from bad to worse in fast speed. The austerity freezing of hiring (1:7) ended up in severe shortages in medical and paramedical personnel. The sharp expenditure cuts deprive hospitals of spare parts and essential material.

Submitted by Charles Hugh-Smith via OfTwoMinds blog,

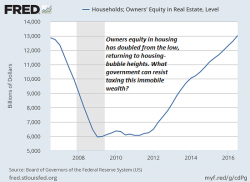

It will be the middle class that accepted the notion that "real estate is the foundation of family wealth" that will be stripmined by higher taxes on immobile assets such as real estate.

Correspondent Joel M. submitted an article that struck me as a harbinger of the future: In Greece, Property Is Debt:

On Wednesday, Greek yields surged when it emerged that diplomatic relations between Greece and the Eurogroup had broken down once again, after European finance ministers suspended negotiations over granting short-term debt relief to Greece as a result of pledges by embattled Greek PM Tsipras unexpectedly said he would grant low-income pensioners a pre-Christmas payoff by spending €600 million to the nation's 1 million low-income pensioners, to replace a Christmas bonus scrapped by the Greek bailout supervisors.