Greece Sells €3 Billion In Bonds In 2x Oversubscribed Offering

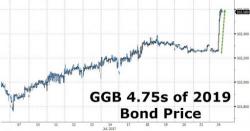

Just over three years after Greece "triumphantly returned" to capital markets in April 2014, when it issued €3 billion in 5 year bonds at a yield of 4.95%, and a cash coupon of 4.75% - an offering which was 8x oversubcribed - and which crashed and nearly defaulted one year later when only the 3rd Greek bailout prevented the country from going bankrupt, only to get taken out at 102, moments ago Greece once again returned to the bond market, if far less triumphantly, by selling another €3 billion in 5 year paper which however was "only" 2x oversubscribed, with indications from Bloomberg that