"We Fought Hard But Did Not Deliver": $2.2BN Hutchin Hill Is Shutting Down

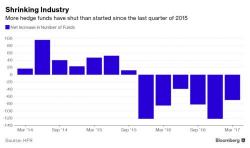

With several months having passed since the last prominent hedge fund closure, the recent narrative that the 2 and 20 community was doing exceedingly well to close out the year (with long/shorts piling into tech names with record leverage), was starting to gain traction. That may have changed this afternoon, when Reuters reported that well-known hedge fund manager Neil Chriss announced he is liquidating his $2.2 billion firm Hutchin Hill Capital LP after three years of poor performance. The firm lost roughly 5.5% in the January-November period after having been up 4.7% in 2016.