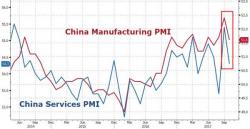

US Futures Rebound After Disappointing Chinese, European Data

Yesterday's sharp Chinese selloff is now a distant memory after the BTFDers emerged, and this morning U.S. equity futures are once again levitating as the FOMC begins its two-day policy meeting, following an uneventful BOJ announcement on Tuesday morning which left all QE parameters unchanged. Asian stocks traded mixed steady while European shares climb.