2018 Will Be When Central Bank Policy Crashes Into the Wall

The bubble in sovereign bonds is looking dangerously close to popping.

And ironically, what could burst it is the very thing Central Banks have been pursuing aggressively for the last 9 years: inflation.

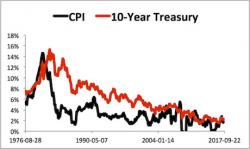

As I explain in my bestselling book The Everything Bubble, Treasury yields adjust to account for inflation. The relationship is not perfect as bonds are also priced based on economic activity. However, the fact remains, if the rate of inflation spikes, Treasury yields rise as well to account for this.

You can see this in the chart below: