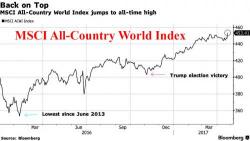

S&P Futs Near All Time High On Strong Euro Data; Oil Drops On Trump's SPR Sale Plans

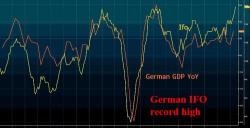

S&P futures rose alongside European stocks as Asian shares posted modest declines. The euro set a new six-month high and European bourses rose as PMI data from Germany and France signaled that the ECB will have to tighten soon as Europe's recovery remains on track, with the German Ifo business confidence printing at the highest level on record, and hinting at a GDP print in the 5% range. Oil declined after the Trump budget proposal suggested selling half the crude held in the US strategic petroleum reserve.