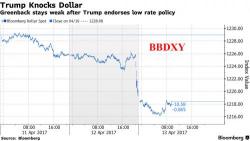

European Stocks, Futures Rebound As Stronger Dollar Eases Haven Demand

European stocks rebounded after the biggest one-day drop since November, alongside S&P futures, while Asian equities posted modest declines after yesterday's weak US close. Gold and yen slid, while the dollar gained on the latest Mnuchin comments to the FT according to which Trump was "absolutely not" trying to talk down the dollar.