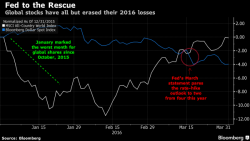

Global Stocks Hit 16 Month High As Draghi’s “Dovish Taper” Sustains “Trumpflation”

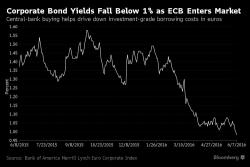

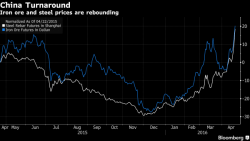

European and Asian shares rose again and S&P futures were little changed, as world stocks were set for a weekly gain and held near 16-month highs on Friday, while the euro steadied after swings following the European Central Bank’s decision to extend its stimulus program. Oil rose a second day before a meeting between OPEC and other major producers on output cuts, industrial metals gain.