Global Markets Flat, Coiled Ahead Of Today's Risk Events: OPEC And The ECB

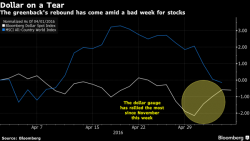

There are just two drivers setting the pace for today's risk mood: the OPEC meeting in Vienna which started a few hours ago, and the ECB's announcement as well as Mario Draghi's press statement due out just one hour from now. Both are expected to not reveal any major surprises, with OPEC almost certainly unable to implement a production freeze while the ECB is expected to remain on hold and provide some more details on its corporate bond buying program, although there is some modest risk of upside surprise in either case.