Nasdaq Flies As Risk Dies And Traders Buy The Bank-Break-Up Dip

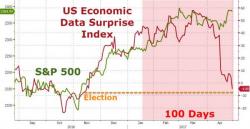

Remember this...

Volume was dismal as most of the world celebrated May Day...Lowest volume of 2017 (and 40% below 2016's May Day volume)

Remember this...

Volume was dismal as most of the world celebrated May Day...Lowest volume of 2017 (and 40% below 2016's May Day volume)

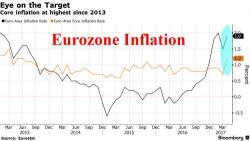

Yeah, this happened...

And so did this...

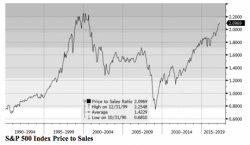

So this...

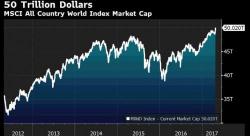

April was a volatile month in markets - bonds, bullion, and stocks higher; crude, copper, and base commodities all tumbled

Despite yesterday's whopping beats by Amazon and Google which sent the Nasdaq to new record highs after hours, and brought Jeff Bezos "this close" to overtaking Bill Gates as the world's richest man, this morning futures S&P futures are little changed ahead of the closely watched Q1 GDP report, European stocks and Asian equities are slightly lower, oil is higher after Russia's energy minister Novak said Russia had reached the 300kbpd oil cut per the OPEC pact, and the dollar was modestly in the red.

Authored by Michael Snyder via The Economic Colapse blog,

After two days of back to back triple digit gains in the Dow for the first time since the election, overnight the torrid rally has faded, with European shares and U.S. stock futures little changed ahead of Trump's big unveil of his much anticipated tax cut plan as investors seek new impetus for a flagging relief rally. And, if as some traders expect, the rally is likely to be reignited no matter what Trump announces today (although a less hyperbolic plan may in fact be more favorable for risk, as it makes Trump's plan more likely instead of being shot down by Congress).