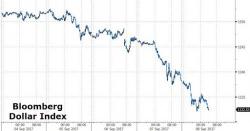

Crashing Dollar Sends European Stocks, US Futures Reeling; Yuan Has Best Week On Record

European stocks dropped, Asian and EM market rose, and S&P were lower by 0.3% as investors assessed the latest overnight carnage in the USD which plunged to the lowest level since the start of 2015, sending the USDJPY tumbling to 107, the euro extending gains to just shy of $1.21 and a slowdown in China’s export growth which however did not prevent the Yuan from posting its best weekly gain on record.