Global Stocks Rise On Strong Economic Data, Dollar Set To End Streak Of Monthly Declines

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

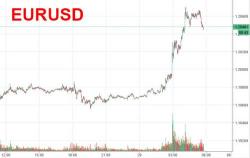

S&P futures are higher in early Wednesday trading, alongside Asian stocks and European bourses, both solidly in the green as the EURUSD drifts below the 1.20 "redline" while the dollar rebounds off a two and a half year low following the US "measured" response to North Korea’s missile test, which soothed jittery investors who now turn their focus to US economic data. Equity indexes in Japan, Hong Kong and South Korea also rose while 10Y US Treasuries are steady before the release of ADP employment and GDP data, both of which are expected to show an increase.

“Financial markets think the only realistic option for the U.S. and North Korea will be to sit down and talk at some point because other options are too costly for everyone involved. But no one can rule out the risk of accidents. Markets think the chicken game will continue for now and North Korea will remain a risk.”

- Masayoshi Kichikawa, chief strategist at Sumitomo Mitsui.

Dow futures down over 120 points (and Nikkei 225 down over 200 points) at the reopen following North Korea's 'successful' firing of a ballistic missile across Japan.

Gold futures spiked to $1325 as USDJPY plunged...

The USDJPY is tumbling on the news... Breaking below 108.50, a break of April's 108.12 may require more than a little help from Kuroda and friends.

Japanese equity market futures plunged to 4-month lows...

And VIX futures are snapping higher...

Via Global Macro Monitor,

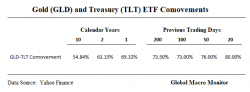

We have posted several pieces over this year noting the high correlation of gold and 10-year bond futures. See here, here and here.