These Were The Best Performing Assets In July And YTD

July was a great month for virtually all asset classes (at least those tracked by Deutsche Bank) with the notable exception of what, which tumbled after surging previously.

July was a great month for virtually all asset classes (at least those tracked by Deutsche Bank) with the notable exception of what, which tumbled after surging previously.

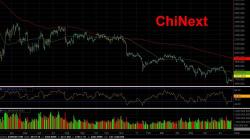

Welcome to August: you may be surprised to learn that S&P 500 futures are once again levitating, higher by 0.3%, and tracking European and Asian markets. Asian equities traded higher across the board after China's Caixin Manufacturing PMI beat expectations and printed its highest since March, refuting the decline in the official PMI data reported a day earlier, while firmer commodity prices boost both sentiment and commodity stocks across Asia and Europe.

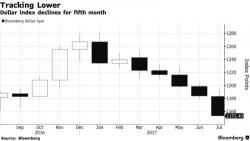

S&P futures have tracked both European and Asian markets lower, which were dragged down by the big EPS miss and guidance cut reported by Amazon on Thursday. Meanwhile, the pounding of the dollar has resumed with the euro and sterling strengthening against the dollar due to renewed political concerns after this morning's stunning failure by the Senate GOP to pass a "skinny" Obamacare repeal after John McCain sided with democrats.

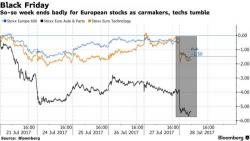

The levitation continues with S&P futures pointing to - what else - another higher open while European stocks swung between gains and losses on the busiest earnings days of the year (85 of the Stoxx 600 report) which has seen European pharma giant AstraZeneca plunge 15%, the most on record, after its flagship lung cancer trial Mystic failed to show benefits, while Deutsche Bank slumped 4% on a 12% plunge in FICC revenue.

Via Global Macro Monitor,

“History doesn’t repeat itself but it often rhymes.” – Mark Twain (maybe)

We have been speaking a lot about how the liquidity in the market today is different than in the past. The chart below reflects this better than anything we have seen.