Via Global Macro Monitor,

“History doesn’t repeat itself but it often rhymes.” – Mark Twain (maybe)

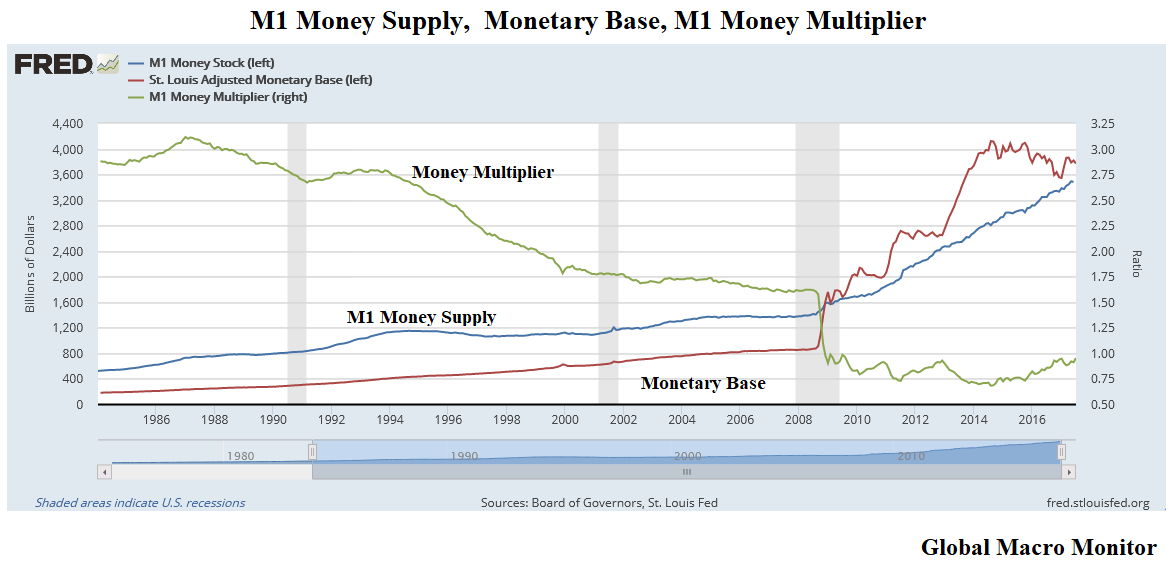

We have been speaking a lot about how the liquidity in the market today is different than in the past. The chart below reflects this better than anything we have seen.

The monetary base in the U.S. has exceeded M1, the most narrow definiton of money, since the financial crisis. The monetary base consists of money in circulation and reserves held at the Fed (see definition below).

The M1 money multiplier is still less than one, which reflects that for every dollar created by the Fed – an increase in the monetary base – results in a less than one dollar increase in the money supply (M1). Credit and deposit creation of commercial banks is thus still impaired, though improving and its repairment may be one reason why the Fed is a bit nervous and in tightening mode.

Watch This Space

A rapid turnaround and improvement in the money multiplier, which may be also be reflected in improving bank net interest margins and growing balance sheets, could act as an early indicator of potential inflationary pressures and a flag that the massive amount of high powered money in the financial system is being converted to credit based money.

The Fed is therefore walking a tightrope of an unstable equilibrium with inflation on one side and deflation on the other, especially if your main policy tool is to pay interest on a large portion of that high powered money. This, as the markets become increasingly convinced the global economy is now in a “Goldilocks” scenario, justifying extreme asset valuations and the record low volatility.

Note, the secular decline in the money multiplier, which reflects many factors, including the almost irrelevance of M1, foreign capital flows, financial innovation, technology and the rise of non-bank banks. For example, private direct lending is all the rage now with hedge funds and other non-bank banks.

Different Kind of Liquidity

The above illustrates why we are in a period of mainly central bank based liquidity rather than credit based liquidity — which can evaporate almost over night with, say, a financial or economic shock — as it did in 2008.

Upshot? It’s all up to the central banks, mainly the Fed and ECB, and when markets perceive it matters that they are removing money/liquidity from the system. And there is a lot of it out there, folks. Flooding the reservoirs with nowhere to go but to overflow into the asset and financial markets.

The stock of reserves in the financial system are what matter now (the Fed’s position), but flows will dominate when the market perceives they are approaching drought level conditions.

There is also a tipping point policy interest rate that will bite the economy and destabilize the markets, but we believe that is at least 100-200 basis points higher. After all,

“John Bull can stand many things, but he cannot stand 2.0 , [-1.5 or 1.25] percent” – Bagehot

Maybe Caterpillar’s earnings release this morning reflects that the excess liquidity is starting to kick into the global economy. Take a look at Dr. Copper breaking out to a two-year high today, though is doesn’t take much copper to write an AI program, does it?

In additon, the future trajectory of the economy and risk markets are also dependent on how and how much credit, liquidity, and “money” — economists can’t even agree on what is money — are now being created. Good luck measuring that.

Markets are acting as if “money” is far from “tight” or nowhere close to getting there. And central banks are too nervous to tighten up monetary conditions to any significant level.

That, in our opinion, is another reason why volatility is breaking to record lows and risk markets are so elevated experiencing only just very shallow pullbacks. And it can, and is, lasting longer than many have expected.

October Correction Is Our Best Guess

We are are waiting for Mr. October to step up and knock the risk markes for a loop, however, resulting in a nice fall correction (pun intended). We believe many factors will be converging by then, including:

1) seasonality;

2) the Fed balance sheet should, or could be shrinking ;

3) China’s Party Congress may have concluded, removing the country’s implicit policy put, and thus increasing the risk of a China policy or economic shock;

4) the new U.S. Federal government fiscal year begins October 1 and if the Trump administration has not passed any significant economic legislation, the markets may begin to throw in the towel;

5) there will be more clarity on ECB tapering;

6) even more elevated asset prices as the risk markets grind higher through the rest of summer as we suspect, setting up for a potential blow-off by the end of September;

7) nervousness over the debt ceiling;

and, finally, 8) by then, the souffle now being baked and puffed up by the markets should barely be able to withstand the slamming of the oven door.

Will it kill the bull? Not until monetary conditions tighten up significantly in our opinion, and the Fed believes the economy can survive a prolonged bear or sideways market, which probably won’t happen unless John Taylor replaces Janet Yellen.

Central banks now, not even with the undercover of, say, a plunge protection team, buy equities outright if they think it will help stimulate aggregate demand. The Bank of Japan is now set to become the number one shareholder in 55 of the Nikkei 225 companies How did we ever get to this place?

A Caveat: Difficulty of Fully Understanding The Global Monetary System

Trying to understand the global monetary system, a black box, in our opinion, is similar to watching shadow puppets dancing on the side of the wall of a cave or seeing through a glass darkly.

The monetary system is too complex and too dynamic for you to understand it all. So it’s better to understand enough that you can be competent, but not so much that you become a danger to yourself. – Cullen Roche

A good friend of mine and great economist, David Herstle Jones, describes the execution of monetary policy as,

“…driving on a narrow mountain road in the fog.” – DHJ

Good luck.

* * *

Appendix:

M1 Money Supply

M1 includes funds that are readily accessible for spending. M1 consists of: (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) traveler’s checks of non bank issuers; (3) demand deposits; and (4) other checkable deposits (OCDs), which consist primarily of negotiable order of withdrawal (NOW) accounts at depository institutions and credit union share draft accounts. Seasonally adjusted M1 is calculated by summing currency, traveler’s checks, demand deposits, and OCDs, each seasonally adjusted separately. – St. Louis Fed, FRED

Monetary Base

The Adjusted Monetary Base is the sum of currency (including coin) in circulation outside Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository institutions at Federal Reserve Banks. These data are adjusted for the effects of changes in statutory reserve requirements on the quantity of base money held by depositories.– St. Louis Fed, FRED

Money Multiplier

The M1 multiplier is the ratio of M1 to the St. Louis Adjusted Monetary Base. For further information on monetary aggregates, please refer to the Definitions, Notes, and Sources at https://research.stlouisfed.org/publications/mt/. – St. Louis Fed, FRED