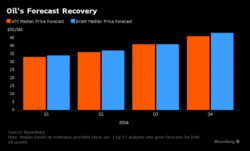

The Wildest Predictions For Oil Prices In 2016

Submitted by Michael McDonald via OilPrice.com,

One reality in the markets is that despite the best efforts of analysts and traders, no one ever knows with any degree of certainty what will happen to the price of an investment in the future. Oil exemplifies that premise right now. All year there has been a tremendous amount of discrepancy in predictions for oil prices with some commentators looking for prices of $10 a barrel and others expecting prices near $100.