OPEC Admits It Has A Problem: It Is Still Producing Too Much Oil

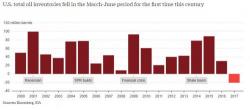

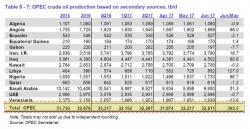

In its just released lastest market report for the month of July, OPEC admitted it has a problem: more than six months after the Vienna deal that was supposed to bring supply and demand in balance, the oil cartel confirmed it is pumping too much, not only in 2017, but also in 2018, blaming shale production as the primary reason behind the oversupply.