FX Weekly Preview: EUR Bursts Higher Again As Year-End Call For 1.2000 Return

Submitted by By Shant Movsesian and Rajan Dhall MSTA of FXdailyterminal.com

Submitted by By Shant Movsesian and Rajan Dhall MSTA of FXdailyterminal.com

Back in mid-2009, we said that with the Fed and central banks nationalizing capital markets, macro and even micro data and newsflow will matter increasingly less and less, and the only thing that does matter is the Fed's weekly H.4.1 statement, showing the changes to the Fed's balance sheet. It also means that so-called "data dependency" is a farce (it is, and has always been "Dow dependency"), and that the impact of incremental newsflow will shrink with every passing week until virtually nobody pays attention (we have largely reached this state now).

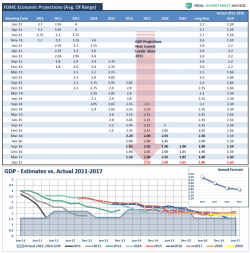

Authored by Richard Rosso via RealInvestmentAdvice.com,

“The emergence of money manager capitalism means that the financing of the capital development of the economy has taken a back seat to the quest for short-run total returns.” – Circa 1992.

Wall Street has forgotten the great financial crisis.

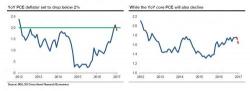

Following disappointing CPI prints for two months in a row, even such stalwart believers in the Fed's tightening cycle as Goldman Sachs (recall Hatzius warned recently that the Fed may need to "shock" markets to tighten monetary conditions in light of the S&P relentless grind higher despite rising rates) are suggesting that the Fed's rate hike trajectory for the rest of 2017 is suddenly in question.

Forget Trump, forget China, forget oil, forget central banks unwinding their balance sheets, forget Reuters trial balloons: there is a far simpler reason why the 'reflation trade' is about to hit a major pothole.