Goldman's 10 Most Important Questions For 2017

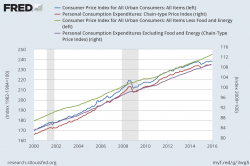

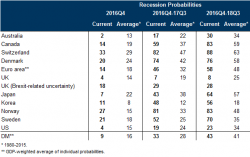

Goldman Sachs is relatively optimistic about growth in 2017, for three reasons: first, despite the lack of spare capacity, US recession risk remains below the historical average; second, financial conditions should remain a growth tailwind - at least in the first half of 2017; and third, we expect a fiscal easing accumulating to 1% of GDP by 2018. However, uncertainty remains and here is what Jan Hatzius and his team believe are the ten most important questions for 2017.

1. Will growth remain above trend?