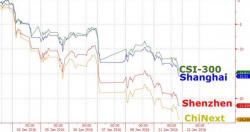

Shanghai Composite Opens Under 3,000 As Onshore Yuan Practically Unchanged For Fourth Day

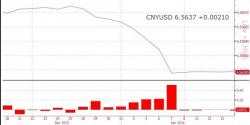

Having made its warning to the Fed loud and clear ("if you hike or otherwise push the USD any higher, we will crush your markets by devaluing the Yuan against everyone but mostly the USD"), the PBOC continued the fragile ceasefire between the world's two most powerful central banks, when moments ago it kept the onshore Yuan virtually unchanged, by weakening today's fixing by 0.03% to 6.5637. However, as can be seen on the chart below, this has barely even registered.