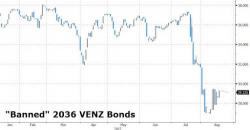

Goldman "Unexpectedly" Exempt From Venezuela Bond Trading Ban

When the White House announced on Friday that Trump had signed an executive order deepening the sanctions on Venezuela, and confirming the previously rumored trading ban in Venezuelan debt that earlier in the week had sent VENZ/PDVSA bonds tumbling, we made what we thought at the time was a sarcastic comment that in light of the recent scandal involving Goldman's purchase of Venezuela Hunger Bonds, that Lloyd Blankfein's hedge fund, which now controls the presidency and next year will also take over the Fed courtesy of Gary Cohn, would be exempt from the trading ban: