Q2 Earnings Preview: "After Strong Q1 Guidance, Watch Out For Weakness In Q2"

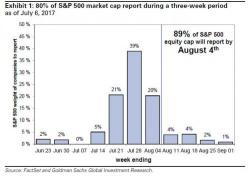

2Q17 earnings season kicks off next Friday with four banks - Citi, JPM, Wells And PNC - reporting results, accounting for roughly 5% of the S&P 500 by market cap. 89% of the S&P500 is expected to report earnings by August 4th. And while most analysts expects a beat vs. consensus (+7% EPS) in 2Q, BofA warns that analysts’ forecasts continue to look overly optimistic for the 2H, particularly in 4Q.