7 Myths Of Investing

Authored by Lance Roberts via RealInvestmentAdvice.com,

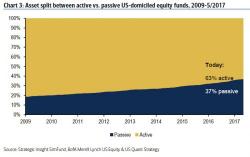

Over the years, I have regularly addressed the psychological and emotional pitfalls which ultimately lead individual investors to poor outcomes. The internet is regularly littered with a stream of articles promoting the ideas of “dollar cost averaging,” “buy and hold” investing, and “passive indexing” as the solution to achieving your financial dreams.