Bitcoin Bloodbath Leads Tech Stock Tumble; Gold Gouged As Credit Curve Crushed To New Lows

hmmm....

We started the day with a gold flash-crash...

hmmm....

We started the day with a gold flash-crash...

Two years after correctly abandoning his long-held bullish perspective on the US economy's growth prospects, Deutsche Bank's chief economist Joe LaVorgna has reportedly left the bank, "planning to work elsewhere in financial services."

Some may recall, that back in 2013, we noted that when it comes to forecasting the future, even one Groundhog Phil has a success rate of 71%, or over a standard deviation more accurate compared to Joe "Coin Toss" LaVorgna's 51%.

Stocks have done well this year and the past 90-days. Which would you rather have owned the past 90-days and Year to date, the S&P 500 or Bond fund ZROZ? Below looks at the performance of the S&P and ZROZ over the past 90-days.

CLICK ON CHART TO ENLARGE

S&P futures point to a higher open following gains in Asian markets supported by stronger commodities but mostly European bourses, which are sharply higher following the €17 billion bailout of the two Veneto banks in Italy, the biggest taxpayer funded bank rescue in modern Italian history, as well as Dan Loeb's activist campaign of the world's biggest food company, Nestle which sent the stock up 5%, and finally Germany's Ifo business climate index which hit new all time highs.

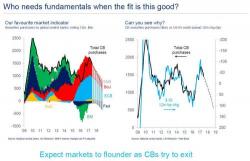

One of the bigger mysteries plaguing sellside analysts in recent weeks has been the seemingly inexplicable divergence between the euphoric market which keeps making new all time highs, and the expectations that global central banks will soon start reducing their balance sheets. it is this divergence that prompted Citi's popular strategist Matt King to predict that he "expects markets to flounder as central banks try to exit"...