Goldman's New Favorite Trade: Make 25x Your Money If Stocks Drop 7%

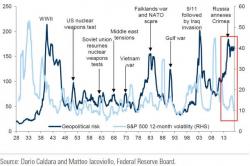

As we have pointed out numerous times, Goldman notes that elevated US policy uncertainty and geopolitical risk indicate heightened risk of more frequent political and geopolitical tail events, in the form of both ‘known unknowns’ or ‘unknown unknowns’...

And given the extreme complacency in markets, Goldman suggests the following trade as a clean way to play that concept of reality emerging into market pricing once again...

Which equity option strategies work in low volatility markets?