Risk... Is How Much You Lose When You're Wrong

Authored by Lance Roberts via RealInvestmentAdvice.com,

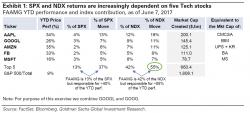

For the last couple of months, we have discussed the risk of the narrowing of leadership as money piled into an ever reducing number of primarily large-cap technology stocks. To wit: