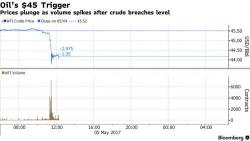

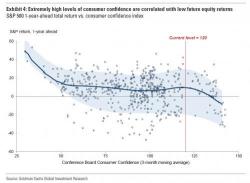

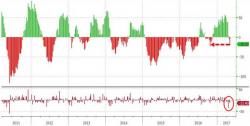

Calmest Market In 75 Years Hits Record Highs - Ignores Dismal Data, Commodity Carnage

Massive liquidity issues in China wealth product liquidation, commodities crashing, oil plunging, US macro data disappointments, US earnings disappointments, and Buffett dumping Big Blue - only makes sense that The Dow just had its quietest 8 days since 1952!!!