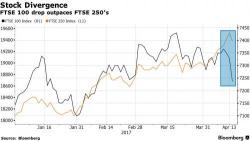

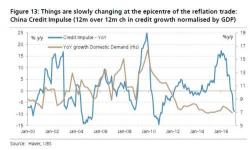

RBC: We Are "Losing The Impulse"

Having held on to hope that the reflationary impulse would sustain the adverse series of events and geopolitical shocks over the past two weeks, RBC's head of cross-asset strategy Charlie McElligott is ready to throw in the towel, driven by what we have been pounding the table on for the past three months, namely the fading inflationary impulse out of China, manifesting itself most vividly in the recent crash in various commodities, and iron ore in particular, which has tumbled 30% from recent highs.