As Stocks Sink, This Is What RBC Is Looking For

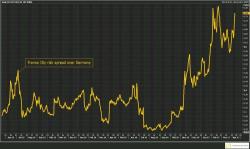

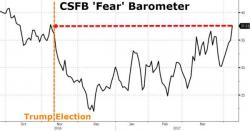

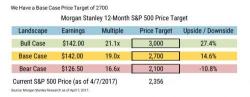

Despite the panicky "reverse engines!" dynamic last Friday in the US rates market - with popular “reflation” trade expressions (which had been seeing vicious unwinds) suddenly breathing new life as Fed’s Dudley clarified his "misconstrued" comments on "little pause" with short-term rates hiking - RBC's head of cros asset strategy Charlie McElligott points out that 5y5y inflation remains stuck, EDZ7/8 curve is flattening again, and the EDZ789 butterfly too is again fading.