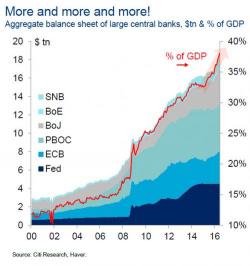

Citi: Central Banks "Took Over" Markets In 2009; In December The "Unwind" Begins

Citigroup's crack trio of credit analysts, Matt King, Stephen Antczak, and Hans Lorenzen, best known for their relentless, Austrian, at times "Zero Hedge-esque" attacks on the Fed, and persistent accusations central banks distort markets, all summarized best in the following Citi chart...

... have come out of hibernation, to dicuss what comes next for various asset classes in the context of the upcoming paradigm shift in central bank posture.