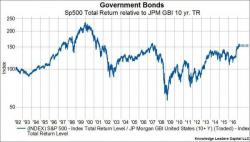

Stock-To-Bond Ratio Back At 2007 Peak

Authored by Bryce Coward via Gavekal Capital blog,

As 1Q17 finishes with a gain in the books, the stock to bond performance ratio has also broken to a new cycle high, elevating to levels not seen since mid-2007.

Our measure of the stock to bond ratio measures the total return of the S&P 500 relative to that of the JPM 10 year treasury total return index. When the blue line rises, stocks are outperforming bonds, and vice versa.