S&P Futures Fade Overnight Gains As Euro Slides; China Stumbles

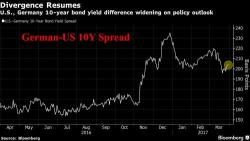

Asian shares and oil are lower, European shares are little changed, and S&P futures are fractionally in the red after gaining for most of the overnight session, perhaps troubled by warnings from two Fed presidents who warned that markets and valuations appear frothy, and the Federal Reserve may have to raise rates more times than currently forecast. The latest round of Fed hawkishness helped the dollar gain further after recent losses which earlier this week pushed it to 4 month lows.