Sizing Up The Bubble - A Major Inflection Point Is Coming

Submitted by John Rubino via DollarCollapse.com,

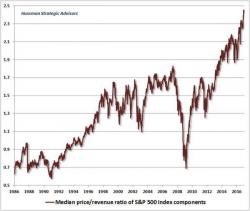

Fund manager John Hussman is always good for dramatic charts. Here’s a recent one:

This ratio is even scarier than it looks, says Hussman:

Submitted by John Rubino via DollarCollapse.com,

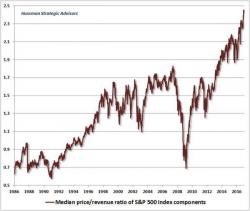

Fund manager John Hussman is always good for dramatic charts. Here’s a recent one:

This ratio is even scarier than it looks, says Hussman:

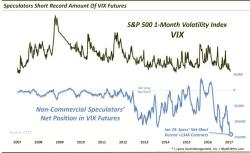

Via Dana Lyons' Tumblr,

Speculators (a.k.a., “dumb money”?) are holding their largest net-short position in the history of the VIX futures contract.

With the S&P500 ending January on the back foot, more pain may be in store for markets in February.

This is the observation of BofA's chief technician Stephen Suttmeyer, who provides several danger signals why bulls may want to be particularly cautious ahead of the coming months.

As he notes, the post-Presidential Election S&P 500 rally has done better than the post-Brexit rally, but there are warning signs moving into February just as there were coming off the mid-August post-Brexit S&P 500 peak.

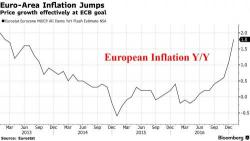

Precious Metals As Safe Havens - Reassessing Their Role

European bonds fell and stocks rose led by banks and retailers as surging inflation data prompted investors to switch into reflationary assets even as speculation about ECB tapering has returned. Asian stocks and US equity futures declined. The Yen and gold advanced after Trump’s firing of the U.S. acting attorney general added to concern over the unpredictability of decisions in the new administration.