Trump Slump Begins? Dow Loses 20k As Stocks Suffer Biggest Drop Of 2017

Probably nothing...

Gold leads 2017...

US equities had their worst day of the year...

Pushing Small Caps back into the red for 2017...

Probably nothing...

Gold leads 2017...

US equities had their worst day of the year...

Pushing Small Caps back into the red for 2017...

Following leaks this morning that the Trump administration is considering executive orders around the H1-B worker via program, tech stocks are tumbling with the Nasdaq down most since September...

Additionally, the S&P 500 just dropped 1.0% for the first time since October...

And VIX is spiking above key technical levels (50DMA) - the biggest spike since September...

Inconceivable?

Dow below 20k...

Dow has filled the 20K cash gap open...

Massive volume spike...

That's likely the 2nd most active 1-second in S&P 500 futures $ES_F

— Eric Scott Hunsader (@nanexllc) January 30, 2017

Remember the trumpflation trade has been questionable for weeks...

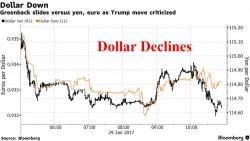

Markets will again zero in on the U.S. this week, and not just because of Donald Trump in Bloomberg's opinion. The Federal Reserve meeting and nonfarm payrolls may set a clear direction for dollar and yields for the next few months. U.S. GDP data on Friday showed the largest negative contribution from net exports since 2010. This will give the president ammunition for his Twitter feed because it confirms his view on the evils of globalization. So prepare. Beyond Trump’s rhetoric, it’s going to be a big week for orthodox economic developments in the United States.

European, Asian stocks and S&P futures all drop after traders were left with a sour taste from the potential fallout of Donald Trump’s order halting some immigration and ahead of central bank decisions from the U.S. and Japan. Markets in Hong Kong, China, Malaysia, Korea, Singapore, Taiwan and Vietnam are all shut due to the Lunar New Year public holiday, leading to a quiet Asian session. Oil rebounded after sliding as much as 0.7%. Gold was unable to hold its overnight gains and has dipped into the red to $1,190 after rising just shy of $1,200 in early trading.