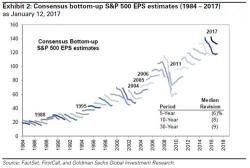

Goldman Is Concerned: "The S&P Has Surged 6% Since The Election But 2017 EPS Forecasts Haven't Budged"

Goldman is starting to get concerned.

Goldman is starting to get concerned.

Submitted by Lance Roberts via RealInvestmentAdvice.com,

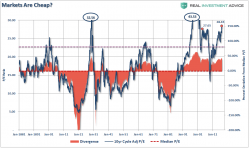

Extremes Become The Norm

One week ago we were surprised to read that, in Tom Lee's 2017 market outlook, Wall Street's formerly most vocal cheerleader and its most prominent permabull had unexpectedly turned into one of the most skeptical bears. As a reminder, at a time when virtually every other Wall Street strategist, even the quasi skeptics, are convinced the market is going nowhere but higher, Lee now expects that the S&P 500 will finish the year virtually unchanged at 2,275, and roughly 3% lower than the median sellside forecast.

We start our Sunday with some gloomy predictions from Morgan Stanley's appreciately named "Sunday Start" periodical, in which the bank's Chief Global cross-asset strategist, Andrew Sheets, explains why the market return under the Obama administration will be a tough act to follow. His argument in a nutshell: "good market environments often involve a shift from economic despair to optimism, and a shift in psychology from ‘fear’ to ‘greed’. Both occurred over the last eight years, producing returns well above the long-run average.

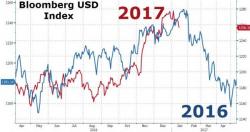

With doubts that the "Trumpflation" trade is over creeping ever higher, leading to a precarious decline in the USD in recent days, and prompting comparisons to the Dollar's move at the start of 2016 when the greenback's ascent dramatically reversed...

... resulting in a pick up in the long end, which has outperformed the Dow YTD in 2017...

... it was surprising to see that traders, seemingly unfazed by recent price action, took their record shorts across the Treasury curve, and made them even recorder.