Morgan Stanley Warns to Sell the Inauguration While Greatly Increasing 2018 Earnings Forecast

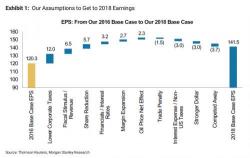

Morgan Stanley is out with a helter skelter note of caution on markets, warning investors to sell the Trump inauguration while upping earnings estimates by 18% for 2018 -- citing material upside in earnings and multiple contraction.

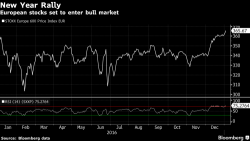

Plainly, if what Morgan Stanley says comes to fruition, stocks should trade higher on the backs of buybacks, fiscal stimulus, and big corporate tax cuts. However, the sages at Morgan are worried about the recent scale of the rally, coupled with Fed hike fever risks, European uncertainty and of course a rising dollar.