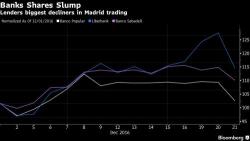

Global Stocks Decline As Trading Volumes Collapse Ahead Of Monte Paschi Nationalization

European, Asian stocks and S&P futures all declined amid collapsing volumes, after the Wednesday drop in the S&P500, and after oil prices held losses amid an unexpected increase in supplies, as traders close out trades ahead of the holidays. Top overnight news include the imminent nationalization of Monte Paschi, the ongoing manhunt for the German Christmas market terrorist, Uber halting its self-driving car test in San Francisco, and the anti-China, anti-regulation moves in the Trump administration.