Party's Over? Bonds, Stocks, Dollar Dive As VIX Jumps Most In A Month

For Bondholders, Big Tech shareholders, and Mexicans, here's the message...

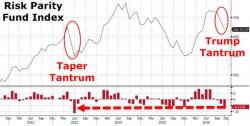

Well if you thought November was turmoily, December is off to a turmoilier start...

For Bondholders, Big Tech shareholders, and Mexicans, here's the message...

Well if you thought November was turmoily, December is off to a turmoilier start...

What else could we use for today...

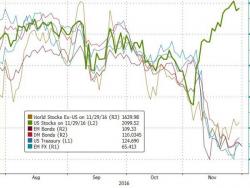

November was quite a month...

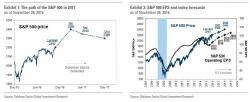

Having warned for nearly all of 2016 that the market is getting ahead of itself on the back of median P/E multiples that are higher than 99% of all historical reading, Goldman chief strategist David Kostin stubbornly kept his year end S&P target at 2,100 on valuation concerns.

European, Asian stocks rise as do S&P futures as OPEC ministers gathering in Vienna appeared to be set to announce a deal to cut oil production and prop up global prices. Oil has surged over 7% as a result, also pushing US TSY yields and the dollar higher.

With all eyes on Vienna, where optimism OPEC ministers will salvage a deal to cut production, oil has soared by over 6% reverberating through the financial markets, spurring oil’s biggest gain in two weeks and sending stocks of energy producers and currencies of commodity-exporting nations higher.

Authored by Bonner & Partners' Bill Bonner, annotated by Acting-Man's Pater Tenebrarum,

Free Money!

Last week, the Dow punched up above 19,000 – a new all-time record. And on Monday, the Dow, the S&P 500, the Nasdaq, and the small-cap Russell 2000 each hit new all-time highs. The last time that happened was on the last day of December 1999.