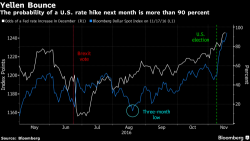

What "The Worst Bond Rout In 15 Years" Means For Stocks

In light of the dramatic spike in interest rates since the Trump victory, where as we reported yesterday and as Bloomberg comments overnight, "yields on benchmark 10-year Treasuries posted their steepest back-to-back weekly increase since 2001" leading to the "the worst rout in the fixed-income universe in 15 years"...

... and which coupled with a surge in the 10-Year breakeven rate - a gauge of US consumer price expectations - to the highest in more than 18 months...